Workers' Compensation

Praetorian Workers’ Compensation Insurance safeguards your company against conflicts and ensures your employees are covered for lost wages and medical costs.

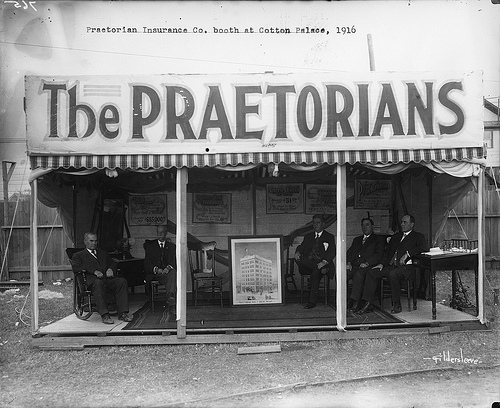

At the heart of Praetorian insurance operating principles, fostering robust relationships is their top priority. Their advanced business approaches, varied product lineup, and seasoned underwriters enable Praetorian insurance to deliver market-leading products and services.

Praetorian’s extensive presence and outstanding financial stability afford their program administrators an optimized operating framework and avenues for future expansion. Furthermore, the Praetorian insurance resilience ensures their continued presence when others stumble.

Capability

- Authorized across 47 non-monopolistic jurisdictions

Present portfolio

- Main workers’ compensation (exclusively guaranteed cost)

- Internal policy management system

- Cutting-edge claims handling, featuring advanced data analytics

Desired business

- Small to large accounts (below $1M)

- Low to moderate risk classifications

- Aim to cover 35 or more states

Protecting Employees and Employers

As an employer, you are responsible for providing a safe and healthy workplace for your employees. However, accidents can still happen, and it is important to have insurance coverage in place to protect both your employees and your business. Workers’ compensation insurance is designed to provide financial support and peace of mind in the event of a workplace injury or illness.

What is Workers’ Compensation Insurance?

Workers’ compensation insurance is a type of insurance that provides benefits to employees who are injured or become ill while on the job. This insurance covers medical expenses, lost wages, and other related costs. In most states, workers’ compensation insurance is required by law, and failure to provide this coverage can result in significant penalties and legal liability for employers.

How Does Workers’ Compensation Insurance Work?

Praetorian Insurance Company offers workers’ compensation policies designed to meet each employer’s unique needs. The policy covers a range of benefits, including medical expenses, lost wages, and disability benefits. The injured employee is entitled to receive these benefits in the event of a workplace injury or illness.

Workers’ compensation insurance policies also include legal defense and settlement coverage. In the event of a lawsuit related to a workplace injury, the policy provides coverage for legal expenses and settlement costs. This coverage protects employers from financial damages and legal liability.

Why Choose Workers’ Compensation Insurance?

Praetorian Insurance Company is committed to providing its clients with comprehensive and effective workers’ compensation insurance. The company works closely with employers to develop customized policies that meet their unique needs and budget. Praetorian Insurance Company also provides extensive resources and support to help employers prevent workplace accidents and promote employee safety.

In addition, workers’ compensation insurance policies offer competitive rates and flexible payment options. The company is committed to providing affordable and adequate coverage to its clients, ensuring they have the protection they need without breaking the bank.

An Essential Component

Workers’ compensation insurance is essential to any business’s risk management strategy. It protects employers and employees from workplace injury or illness. Workers’ compensation policies offer comprehensive coverage and peace of mind, protecting employers and employees from financial damages and legal liability. If you are looking for a reliable and effective workers’ compensation insurance policy, contact Praetorian Insurance Company today to learn more.